Nordea

Product Development — Product Design

Nordea came to us with the challenging task of getting young adults to start saving for their retirement. Through user research and lots of interviews with the target demographic we realized that young adults are interested in having a healthy economy but naturally, a lot of other expenses are prioritized before anyone sets aside money for 40+ years in the future. No 20 year old will skip this years holiday to save for retirement.

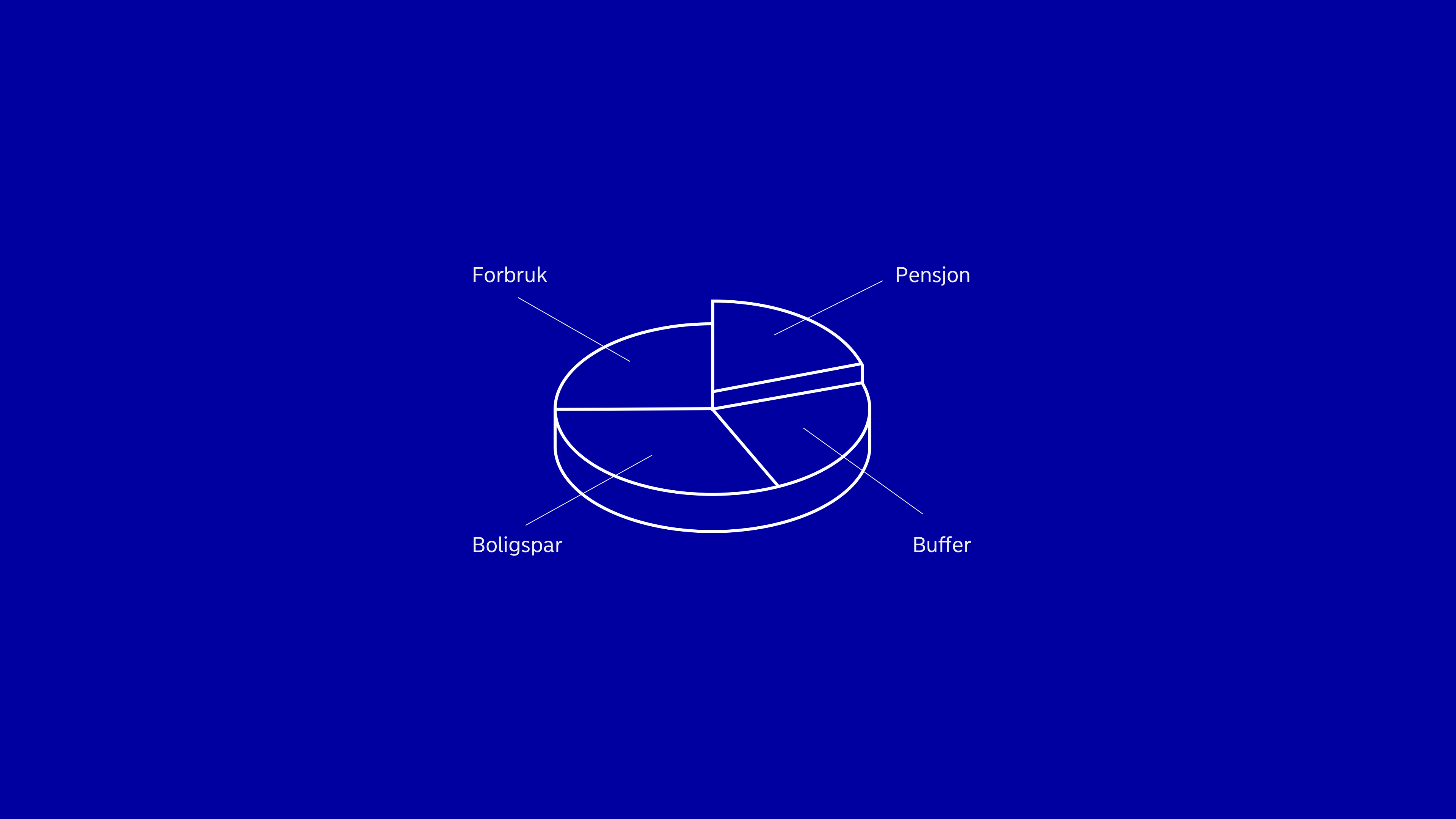

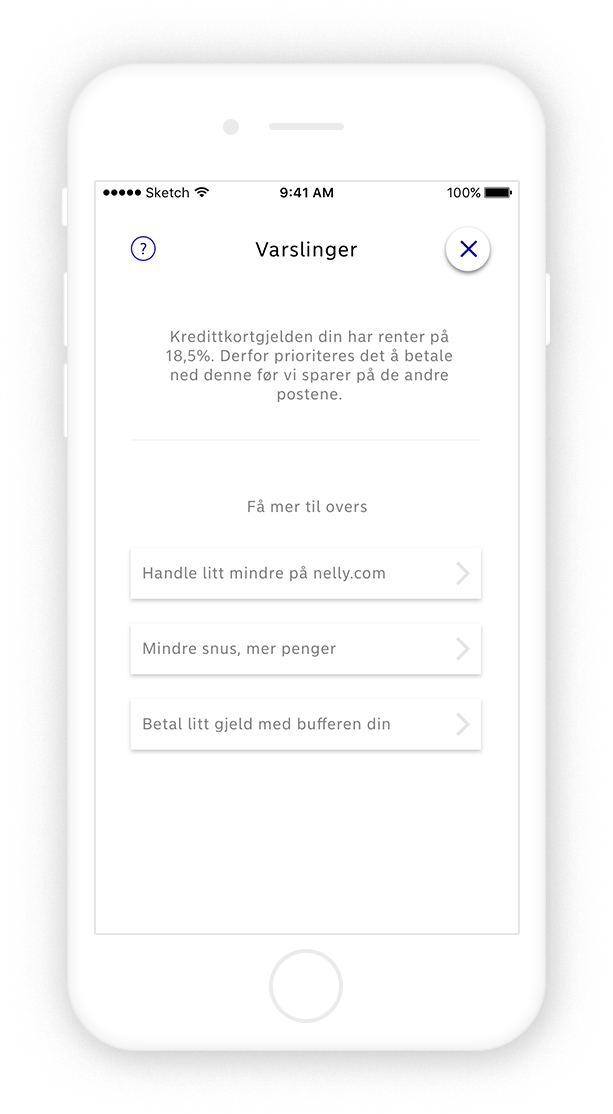

Economic turbulence was common for our demographic who may be studying, having just started their first job or are between jobs without a foundation of savings to fall back on. Retirement is only a slice of the economic decisions they have to deal with. We asked ourselves why isn't there a one-button "fix my economy"-solution? It's hard to think ahead and plan for the future when you don't know how your economic situation will be the next month, or maybe even next week.

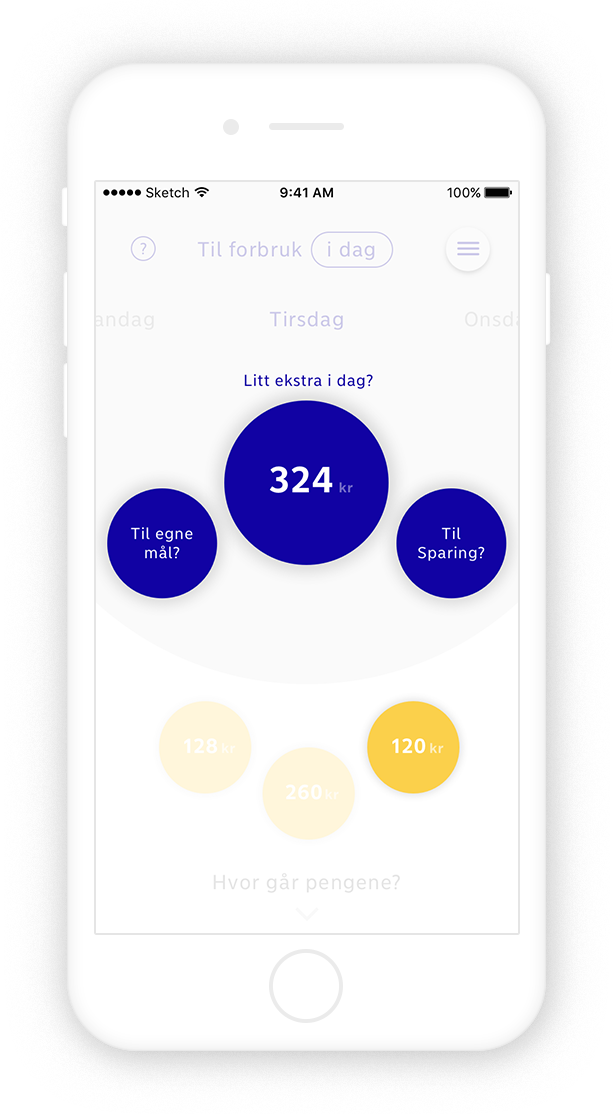

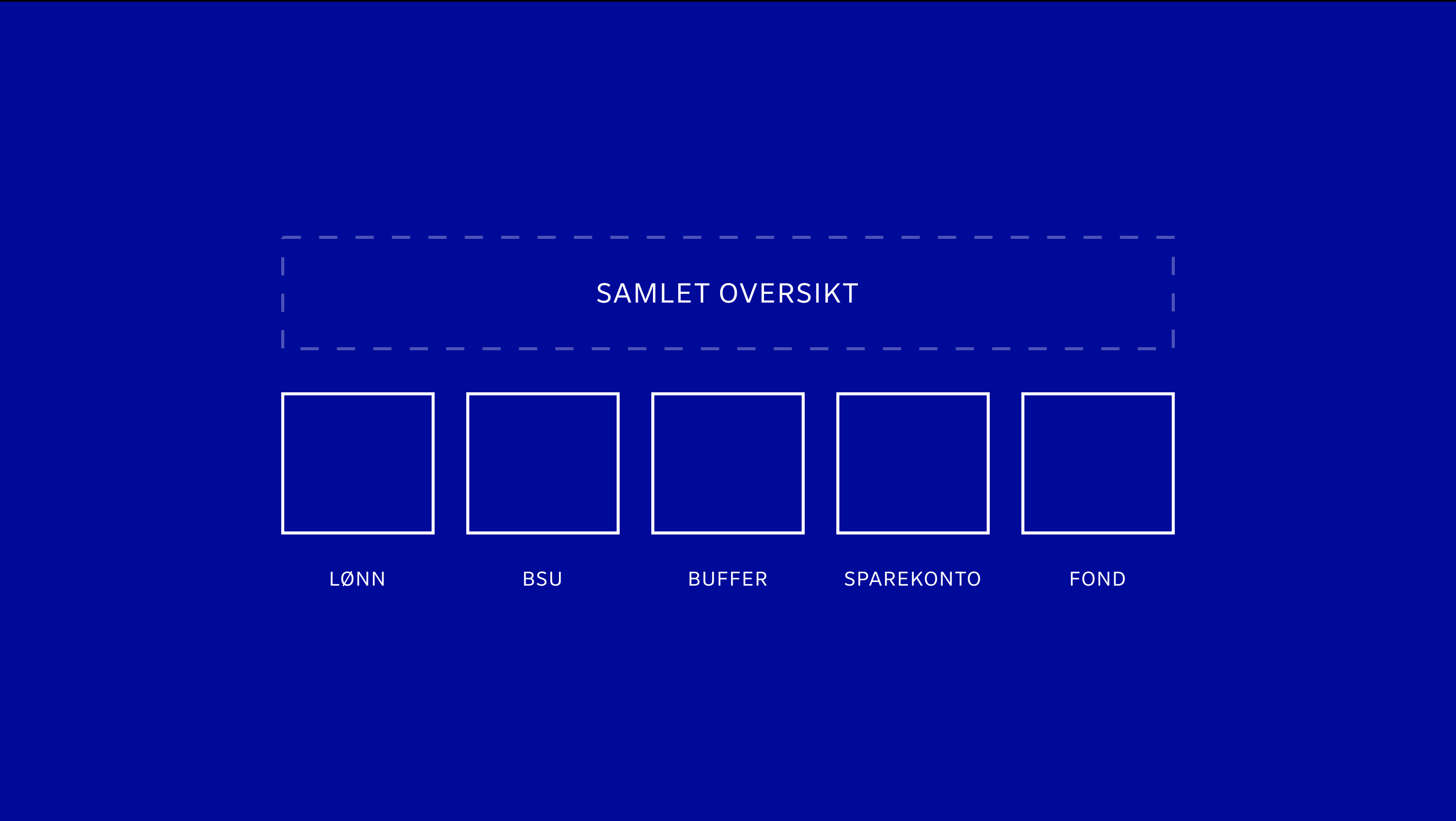

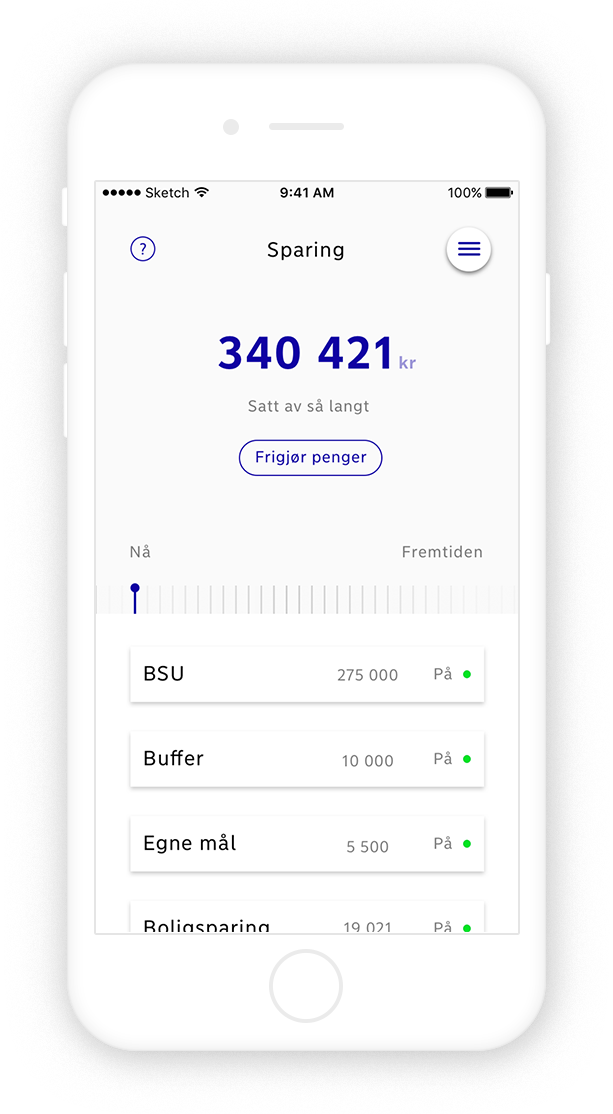

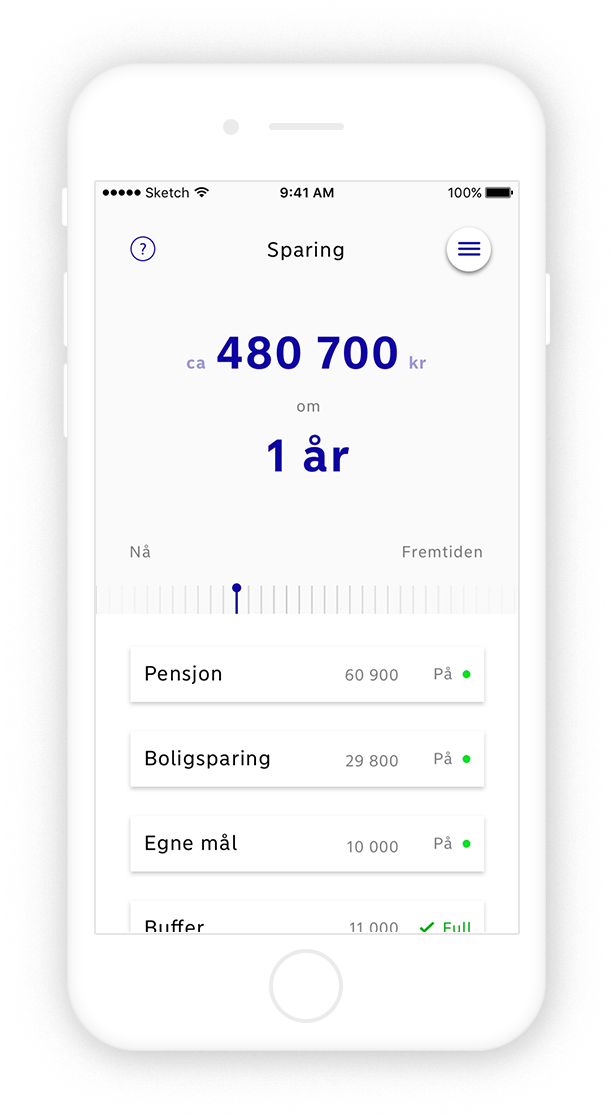

Our ambition became to fix your economy today, tomorrow and for the future. By automating your bank accounts we could delegate an amount of money to where it matters most but give you a daily budget, a way of thinking about money many of the young adults shared. An example of the smart economy we proposed is automating the balance between setting aside money for BSU (Tax benefits), establishing a rainy day fund (for emergencies) before setting aside money for retirement unless interest and capital gains add up.

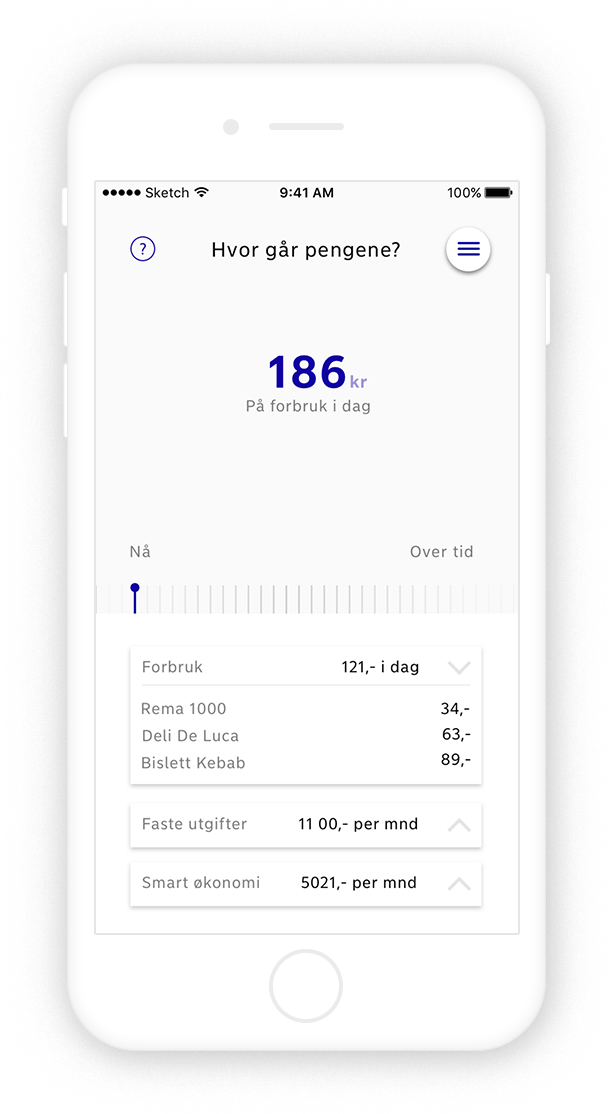

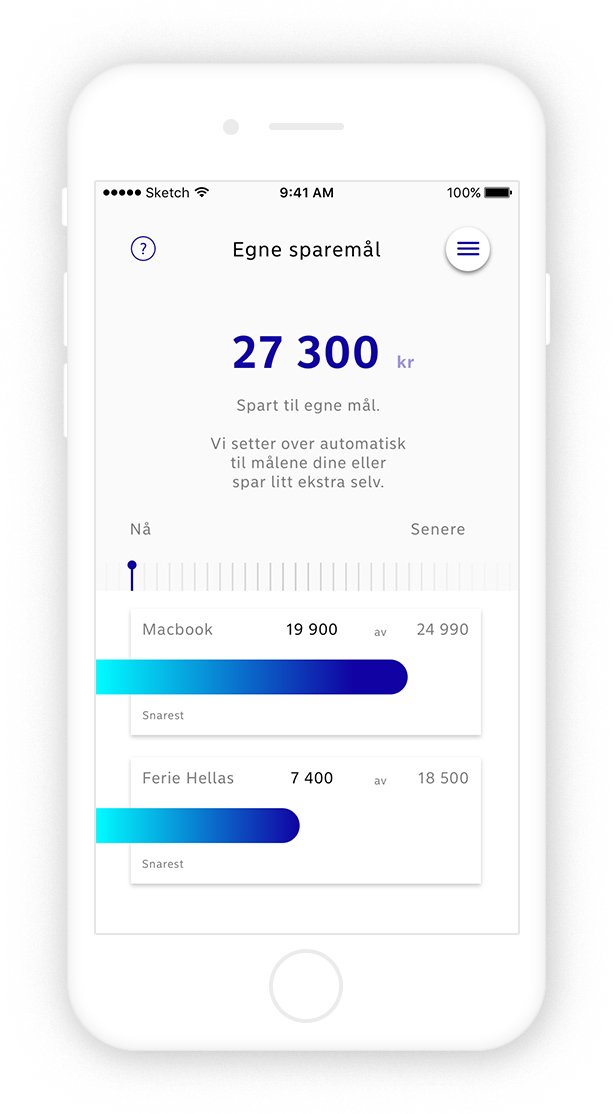

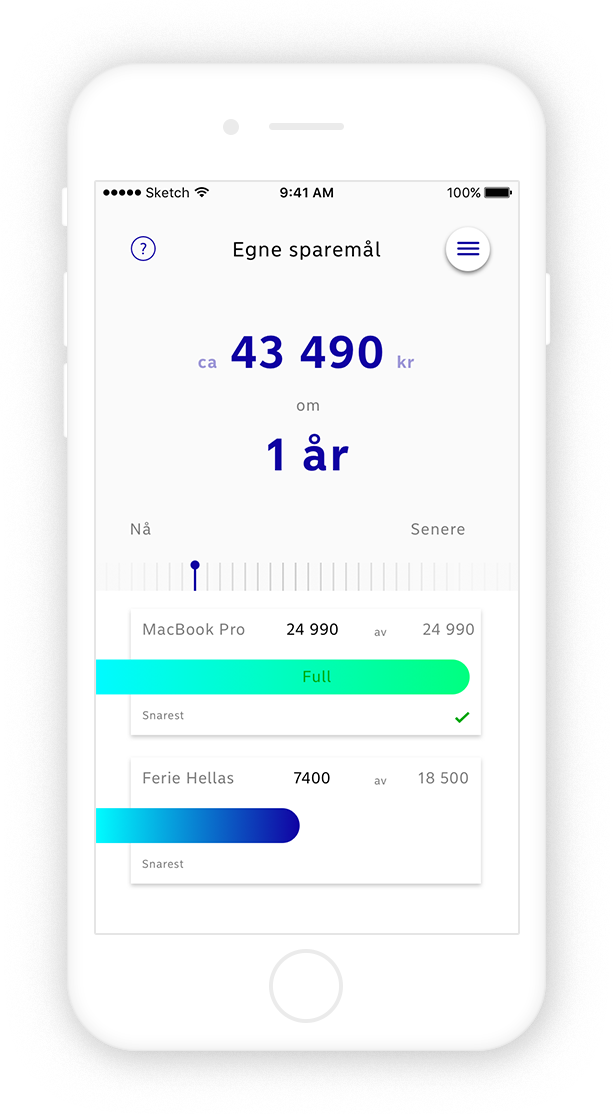

Empathy was a huge factor for the entire concept. Never pointing fingers, but nudging users towards better decisions by show the positive effect. By letting users set short term goals like a new computer or a holiday, we display the effect of saving over time. We also looked into ways to shift time, visualizing what your funds or expenses will be in a year if the current habits are kept.

Following are some of the rough sketches for the solution. Prototyping was done in Framer to allow us to test some of the interactions we came up with.